Extended Validation displays the green verified address bar in end user browsers. A Type II report not only includes the service organization’s description of controls, but also includes detailed testing of the design and operating effectiveness of the service organization’s controls.

70 (SAS 70 Audit) is widely recognized, because it represents that a service organization has been through an in- depth audit of their control objectives and control activities, which often include controls over information technology and related processes. A service auditor’s examination performed in accordance with SAS No. Securities and Exchange Commission (SEC) as an acceptable method for a user organization’s management to obtain assurance about service organization’s internal controls without conducting separate assessments. The examination included the company’s controls related to security monitoring, change management, service delivery, support services, backup and environmental controls, logical and physical access. Completion of the examinations indicates that selected Rackspace’s processes, procedures and controls have been formally evaluated and tested by an independent accounting and auditing firm. WorkSpace™ Portal uses 256 bit encryption using HTTPS secure protocol and is also FINRA and HIPPA compliant.

The datacenter for WorkSpace™ Portal is maintained by Rackspace Hosting which has completed an examination in conformity with Statement on Auditing Standards No.

Method used to sign the record,(e.g., typed name) or a system log or other audit trail that reflects the completion of the electronic signature process by the signer.Identity verification: taxpayer’s knowledge based authentication passed results and for in person transactions, confirmation that government picture identification has been verified.Taxpayer’s login identification – user name (Remote transaction only).Taxpayer’s computer IP address (Remote transaction only).

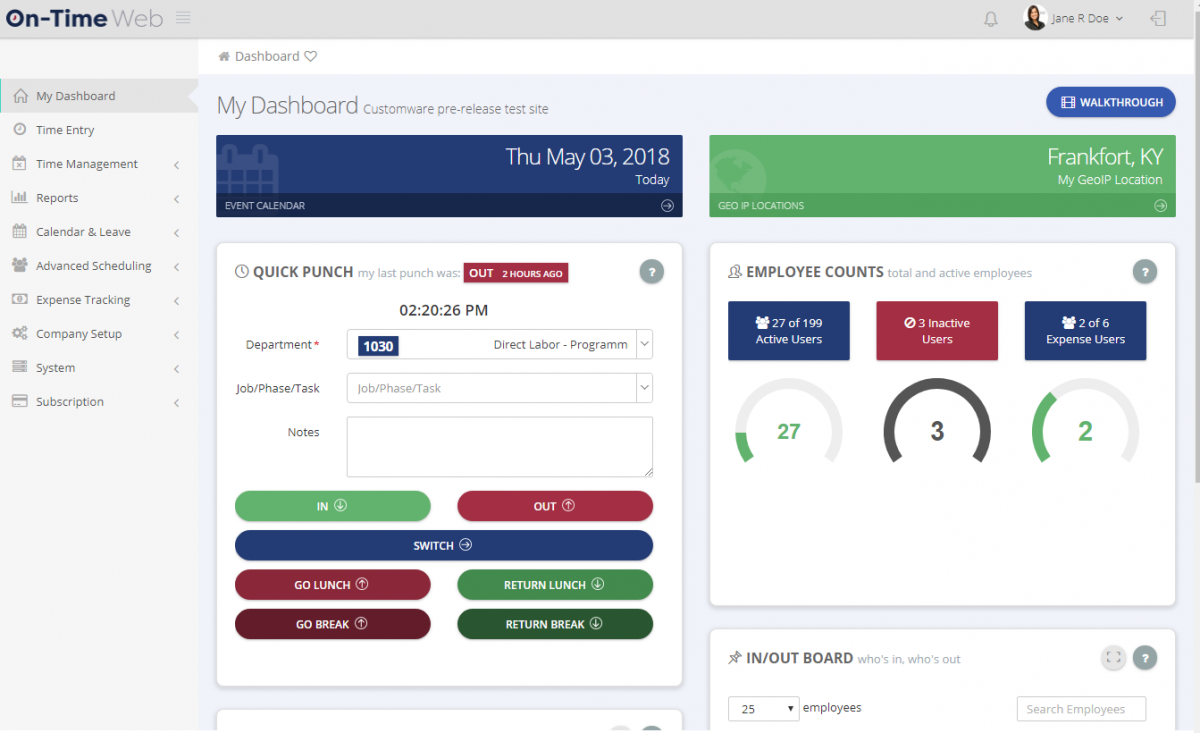

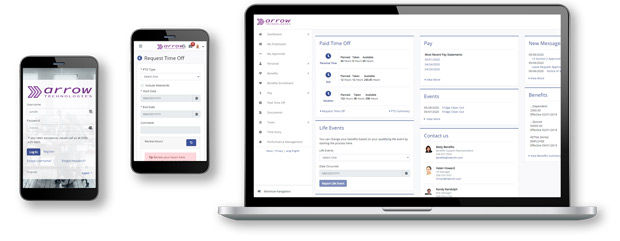

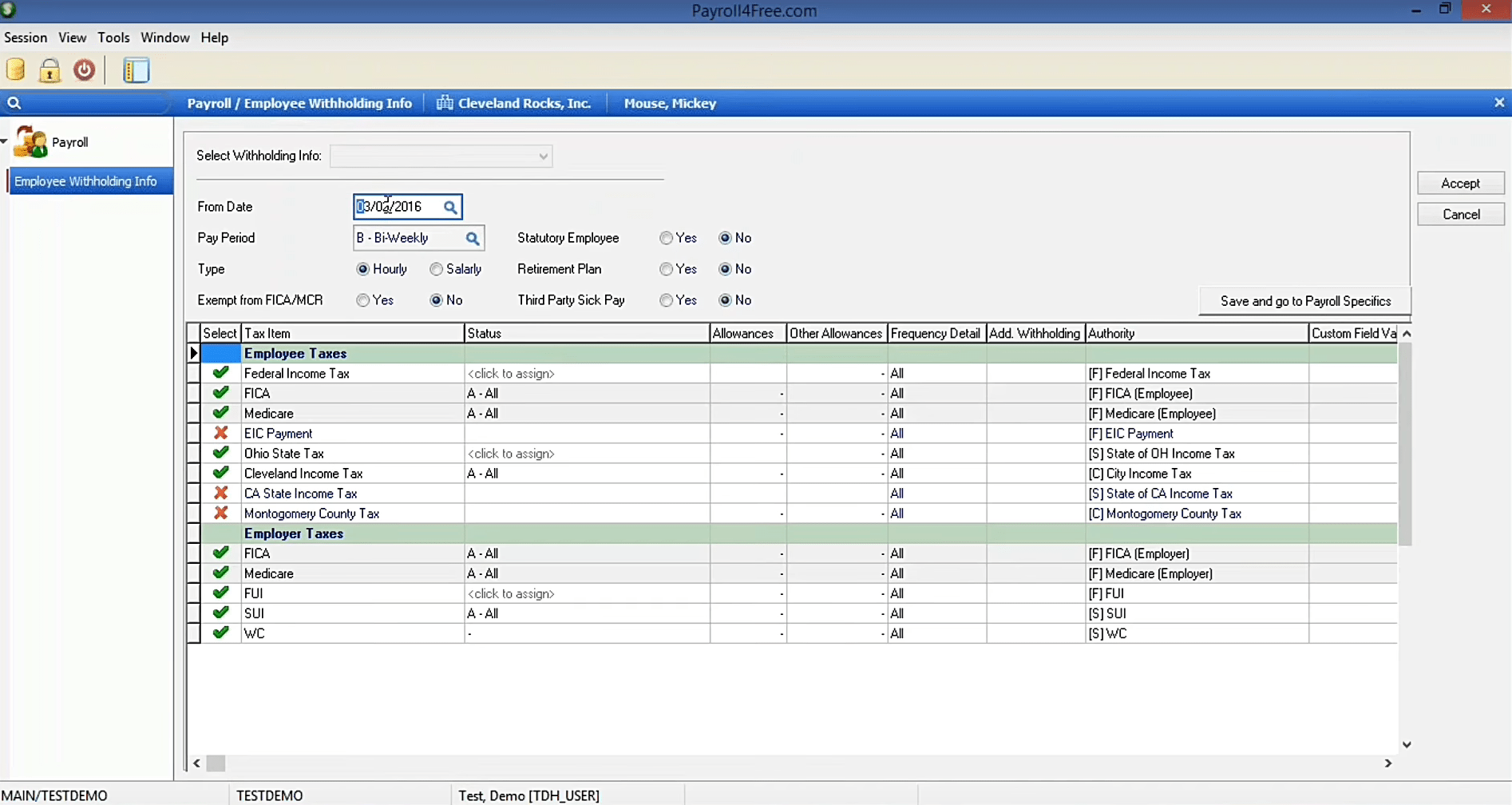

#Ontime payroll client portal software#

That means our compliant eSignature software solution must record the following data: We adhere to the current IRS Electronic Signature Guidance

#Ontime payroll client portal free#

With state of the art payroll facilities and dedicated payroll staff, we’re able to efficiently pay your staff, leaving you free to concentrate on the day to day running of your business. We ensure all payroll procedures and documentation is submitted and filed with HMRC on time, and since we’re aware of changing tax and employment legislation you don’t run the risk of being fined for noncompliance. Outsourcing your payroll to GM&Co means that you benefit from trained staff overseeing the payment of wages. Here at GM&Co we appreciate the importance of paying your employees the right amount of money at the right time. Outsourcing payroll to trained accountants is becoming a more popular option for small businesses. With statutory payments, holiday pay, bonuses, overtime and pay rises making the task of paying employees extremely complex. In house-payroll can be an extremely confusing, time consuming and laborious task.

0 kommentar(er)

0 kommentar(er)